Earning yield on stablecoins doesn't have to mean trusting a centralized exchange or navigating complex DeFi protocols. On Lendasat, you can lend directly to Bitcoin holders, earning a fixed, predictable yield secured by overcollateralized, on-chain Bitcoin.

With our latest interface update, creating a lending offer is more intuitive than ever. You have full control to define what you lend, how long you lend it for, and the risk parameters you are comfortable with.

This guide walks you through the new interface, explaining not just which buttons to click, but how to structure your offer for the best results.

The Lendasat Lending Model

Before diving into the form, it is important to understand what happens when you create an offer. Unlike liquidity pools where your funds are deposited immediately, Lendasat operates on an order book model.

When you create an offer:

- You retain custody: Your funds stay in your wallet until a specific borrower accepts your terms.

- You set the rules: You define the APR, duration, and collateral requirements.

- Bitcoin is the bedrock: No loan starts until the borrower locks Bitcoin in a 2-of-3 multisig escrow.

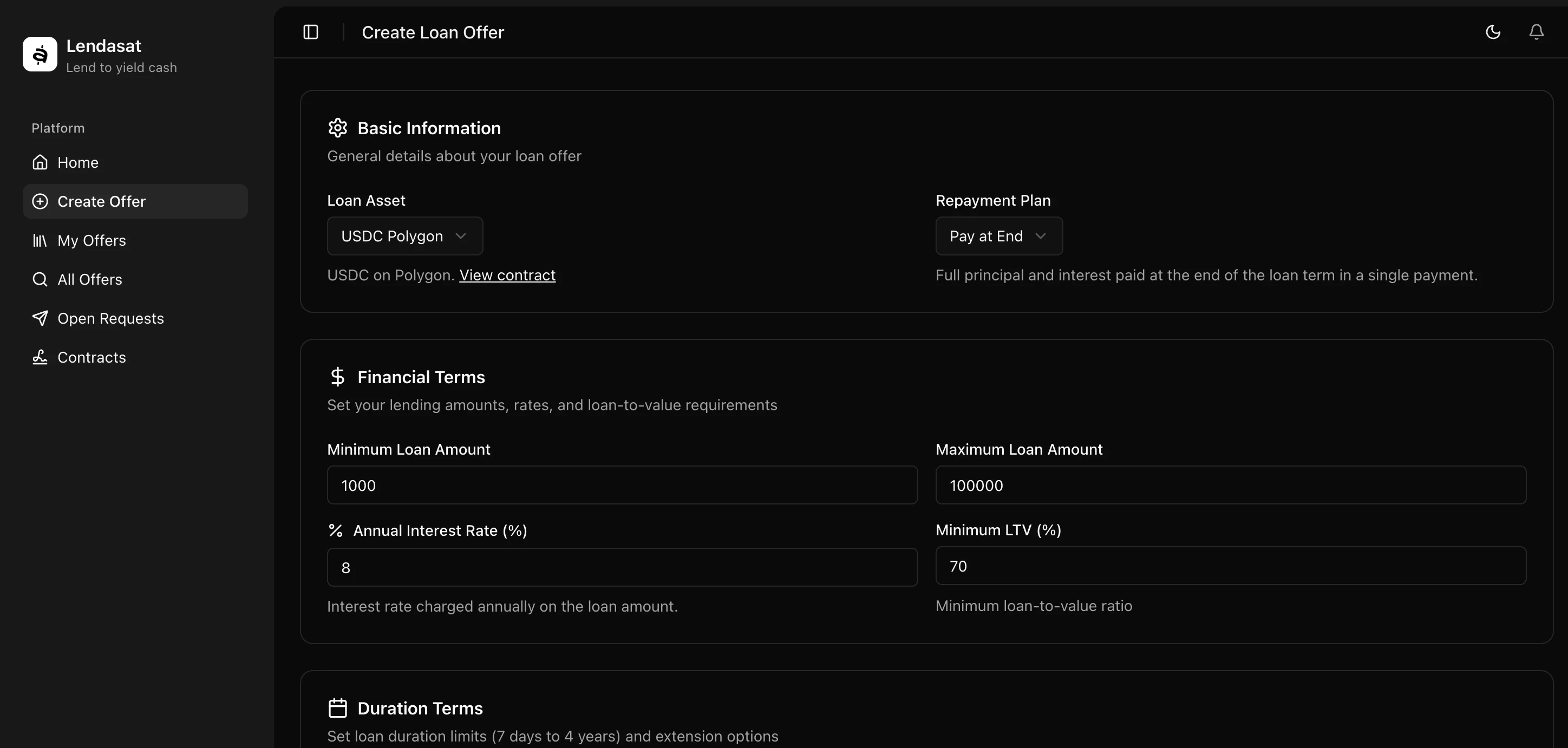

Step 1: Defining the Asset and Repayment Structure

The first section of the interface establishes the fundamental "what" and "how" of your loan offer.

Selecting the Loan Asset

Currently, the standard for liquidity on Lendasat is USDC on Polygon. We recommend using this network for maximum compatibility. Specifically, if you want your offer to be available to borrowers using authorized fiat gateways (like our integration with Bringin for Euro loans), using USDC on Polygon is required.

Note: Always remember that repayments must occur on the same network. If you lend on Polygon, you will be repaid on Polygon.

Understanding the Repayment Plan

Lendasat uses a "Pay at End" (or bullet repayment) structure. This offers lenders maximum predictability. The borrower repays the principal plus the full interest amount in a single transaction at the end of the loan term.

A key benefit for lenders here is the interest guarantee: even if a borrower decides to repay the loan early, they are contractually obligated to pay the full interest amount for the agreed duration.

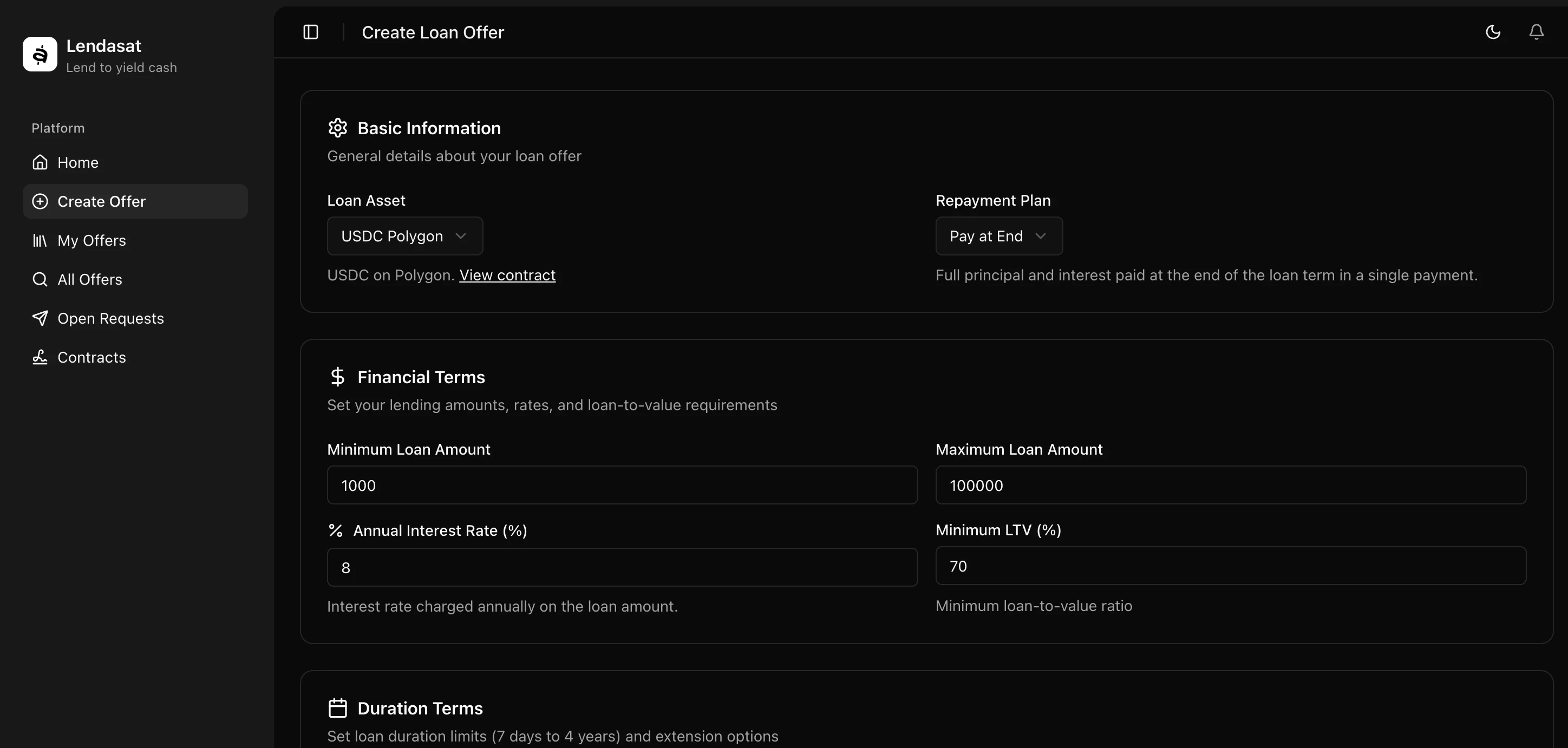

Step 2: Setting Your Financial Terms

This section is where you define your risk and reward profile.

Loan Sizes (Minimum vs. Maximum)

You define the range of capital you are willing to deploy.

- Minimum Loan Amount: This filters out small borrowers. For example, setting this to $1,000 ensures you don't have to manage dozens of micro-loans.

- Maximum Loan Amount: This is the cap on a single loan. If you have $100,000 to lend, setting a max of $100,000 allows a single large borrower to take the full offer, while the minimum setting allows smaller borrowers to take portions of it.

Annual Interest Rate (APR)

This is your fixed yield. Unlike DeFi rates that fluctuate every second based on utilization, the APR you set here is locked in for the duration of the loan. Whether the market goes up or down, your return remains constant.

Configuring Safety: Minimum LTV

The Loan-to-Value (LTV) ratio is your primary risk management tool. It dictates how much Bitcoin collateral the borrower must lock up relative to the loan size.

| Setting | Requirement | Risk Profile |

|---|---|---|

| Standard (70%) | Borrower locks ~$143 BTC per $100 loan | Higher demand, standard safety |

| Conservative (50%) | Borrower locks $200 BTC per $100 loan | Max safety against volatility |

While a higher LTV (70%) might be more attractive to borrowers, a lower LTV (50%) provides a massive safety buffer against Bitcoin price volatility. Regardless of your choice, the protocol enforces liquidation at 90% LTV to protect your principal.

Step 3: Managing Time and Liquidity

The "Duration Terms" section controls how long your capital is locked. This is vital for managing your personal liquidity needs.

Duration Range

You set a Minimum and Maximum duration (in days).

- If you want a high turnover strategy, you might set a range of 7 to 30 days.

- If you want "set it and forget it" passive income, you might offer loans from 90 to 360 days.

The Extension Option

You will see an optional field for "Extension Duration." Unlike traditional finance where terms are often murky, Lendasat is explicit: Extensions are never automatic.

If you fill in this field, you are giving the borrower the option to request an extension at maturity. You retain the right to approve or deny that request when the time comes. If you leave this field blank, the loan must be settled in full at the maturity date with no option to extend.

Step 4: Your Repayment Destination

The final step is purely logistical but critical. You must provide the wallet address where you want to receive your principal and interest.

For security and ease of use, we recommend using the "Connect Wallet" feature to autofill this field. If you paste the address manually, triple-check that it matches the network of the asset you are lending (e.g., an Ethereum/Polygon address for USDC). An incorrect address here could result in the loss of funds upon repayment.

What Happens After You Click "Create"?

Once you click Create Loan Offer, you sign a message with your wallet to publish the terms to the order book. No funds move yet.

Here is the lifecycle of your capital from this point forward:

- Matching: A borrower sees your offer and accepts it.

- Approval: You review the request (you have a 24-hour window) to ensure you are still ready to lend.

- Collateralization: The borrower locks their Bitcoin into the 2-of-3 multisig escrow.

- Funding: Only after the blockchain confirms the Bitcoin is locked does the protocol prompt you to send the stablecoins.

- Maturity: You receive your principal plus interest directly to your wallet.

Best Practices for New Lenders

If you are creating your first offer, consider these strategic tips:

- Start Conservative: An LTV of 50–60% offers incredible security. It ensures that even during a significant market crash, there is ample room to liquidate the collateral before your principal is threatened.

- Maximize Compatibility: Using USDC on Polygon opens your offer to the widest range of borrowers, including those off-ramping to Fiat via Bringin.

- Ladder Your Durations: Instead of locking all capital for 360 days, consider offering a range (e.g., 30–90 days) to keep your liquidity flexible.

By following this structure, you ensure that your lending offer is attractive to borrowers while keeping your capital strictly within your risk tolerance. Ready to put your assets to work?