Bitcoin holders often face a dilemma: you need liquidity, but you don't want to sell your BTC.

Selling Bitcoin can mean missing future upside, triggering taxes, and giving up sovereignty. Borrowing against your Bitcoin solves this — and with Lendasat, you can do it on-chain, non-custodially, and without selling a single sat.

This guide walks you through exactly how to borrow stablecoins using Bitcoin as collateral on Lendasat, from choosing a loan offer to reclaiming your BTC.

What Does It Mean to Borrow Stablecoins Against Bitcoin?

Borrowing against Bitcoin means you lock BTC as collateral and receive a loan in stablecoins (USDC or USDT).

Your Bitcoin remains yours, secured in a 2-of-3 multisig escrow, and is returned once the loan is repaid.

This is a Bitcoin-native alternative to selling BTC or relying on custodial lenders.

Why Borrow Instead of Sell?

- Maintain long-term exposure to Bitcoin

- Access stablecoin liquidity for expenses or opportunities

- Avoid centralized custody and forced liquidations

- In most jurisdictions, borrowing is not a taxable sale (consult a professional)

How Lendasat Bitcoin-Backed Loans Work

Lendasat is a peer-to-peer lending protocol built natively on Bitcoin, not a bank or a custodian.

- Loans are overcollateralized

- BTC is locked in a non-custodial multisig

- Loan terms are fixed and transparent

- Stablecoins are sent directly to your wallet

You never give up control of your Bitcoin.

Step-by-Step: How to Borrow Stablecoins Using Bitcoin on Lendasat

Step 1: Create Your Lendasat Account

When you sign up, Lendasat automatically generates a non-custodial Bitcoin wallet for you.

Important: Back up your seed phrase securely. Lendasat cannot recover it for you.

Step 2: Find a Stablecoin Loan Offer

Navigate to "Find Offer" and set your preferences:

- Loan amount

- Loan duration

- Payout method: Stablecoins (USDC or USDT)

Lenders define the terms, including:

- Loan-to-Value (LTV)

- APR (interest rate)

- Duration

- Blockchain network for stablecoin payout

Browse offers and select the one that best fits your needs.

Step 3: Enter Required Addresses

You'll be asked for two addresses:

-

Collateral Refund Address (Bitcoin)

This is where your BTC will be returned after repayment.

For privacy, use a fresh, unused BTC address.

-

Loan Address (Stablecoins)

This is where you'll receive USDC or USDT.

Make sure the address matches the exact blockchain network specified in the loan offer (e.g., Polygon, Ethereum, Solana).

Double-check both addresses before proceeding.

Step 4: Submit the Loan Request

Click "Pick Offer."

- The lender is notified instantly

- They have up to 24 hours to approve the request

Once approved, the contract is ready to be funded.

Step 5: Lock Your Bitcoin Collateral On-Chain

After approval, Lendasat displays a Bitcoin address secured by a 2-of-3 multisig.

- Send the required BTC collateral to this address

- You may overcollateralize to reduce liquidation risk

- Funds remain locked until repayment or liquidation

Your Bitcoin is now secured on-chain.

Step 6: Receive Your Stablecoins

Once your BTC transaction confirms:

- The lender sends the stablecoin principal

- Funds arrive directly in your wallet

- You are free to use them immediately

You now have liquidity without selling your Bitcoin.

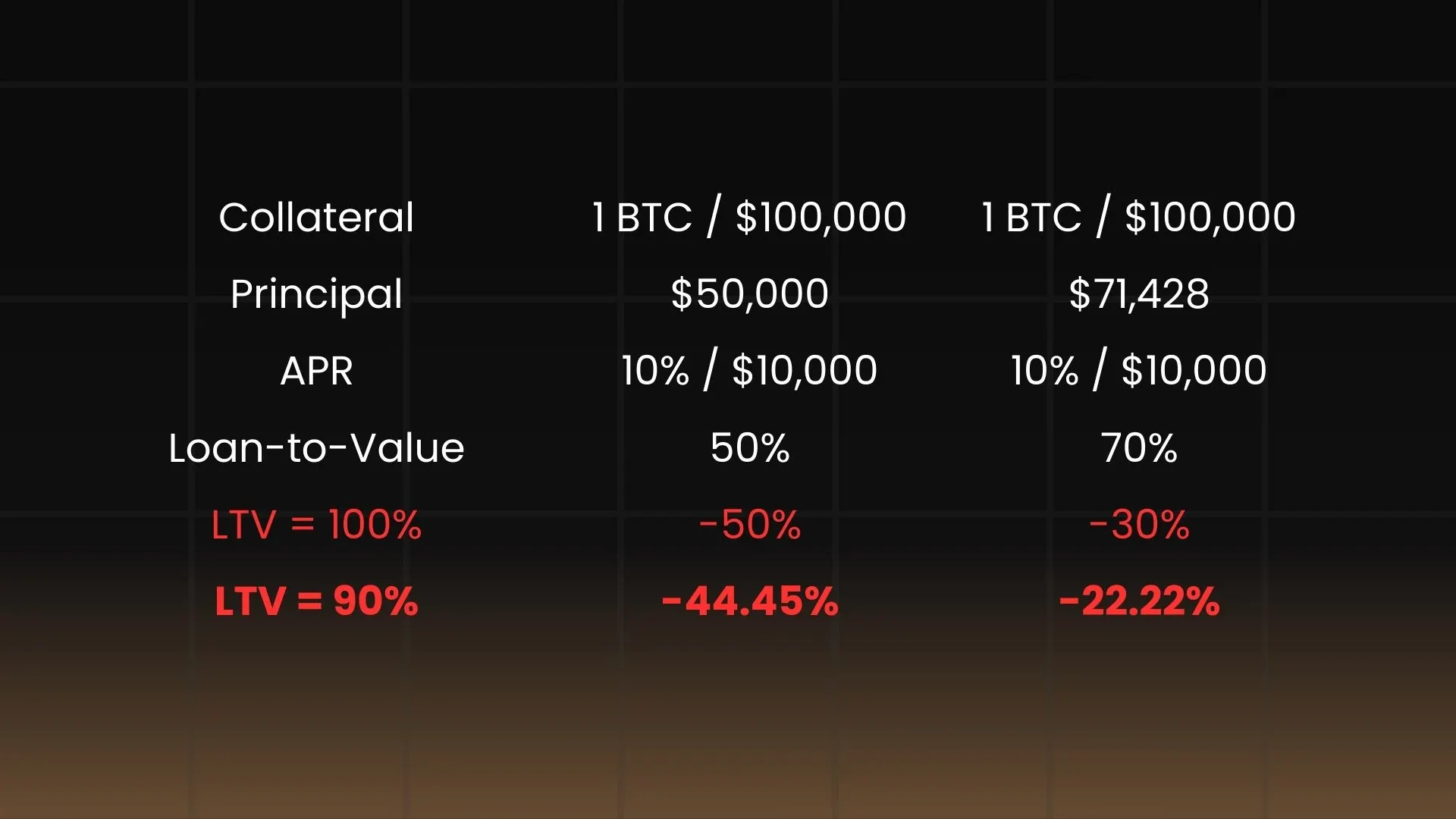

Understanding Risk: LTV and Liquidation

What Is Loan-to-Value (LTV)?

LTV measures how much you borrow relative to your BTC collateral.

Example:

- BTC price: $100,000

- Collateral: $20,000 in BTC

- Loan: $10,000

- LTV = 50%

Liquidation Thresholds

If BTC price drops and LTV rises:

| LTV Level | Status |

|---|---|

| 50-70% | Safe zone |

| 80% | Warning |

| 85% | Urgent warning |

| 90% | Liquidation |

To avoid liquidation, you can:

- Add more BTC collateral

- Repay the loan early

How to Repay Your Loan and Get Your BTC Back

Step 1: Start Repayment

Go to your active loan and click "Manage Loan."

You'll see:

- Repayment amount (principal + interest)

- Stablecoin asset and network

- Repayment address

Step 2: Send Repayment

- Send the full amount in the same stablecoin and network

- Submit the transaction hash as proof

Step 3: Reclaim Your Bitcoin

Once the lender verifies repayment:

- Your BTC is automatically released

- Funds are sent to your refund address

- The contract is complete

Your Bitcoin is back under your full control.

Why Borrow Stablecoins on Lendasat?

| Feature | Benefit |

|---|---|

| Bitcoin-native | Built on Bitcoin, not a sidechain |

| Non-custodial | You control your keys |

| On-chain transparency | Verify everything yourself |

| No rehypothecation | Your BTC isn't lent out again |

| Peer-to-peer rates | Market-driven, competitive terms |

Lendasat brings the "Borrow. Don't Sell." strategy to Bitcoin — without banks, without custody, and without compromise.

Ready to Borrow Against Your Bitcoin?

If you're holding BTC and need liquidity, borrowing stablecoins on Lendasat lets you unlock value today while staying long Bitcoin.

Explore live loan offers on Lendasat and borrow without selling.