Bitcoin is the pristine collateral of the digital age, yet many holders face the "Bitcoiner’s Dilemma": being asset-rich but cash-poor.

When real-life expenses arise, whether for a business opportunity, home renovation, or tax bill, the default reaction is often to sell. However, selling comes with high costs: triggering taxable events, losing your position, and missing out on future price appreciation.

There is a better way. By utilizing a Bitcoin-backed loan, you can "time-shift" value, pulling purchasing power from the future while keeping your underlying asset secure today.

This guide explains the mechanics of non-custodial lending, how to use your BTC as collateral on Lendasat, and how to execute this strategy safely.

The Strategy: Asset-Backed Lending

Unlocking liquidity is not the same as trading or leverage. It is a strategic financial tool used by high-net-worth individuals in traditional finance (often borrowing against stock portfolios or real estate) that is now available to Bitcoiners.

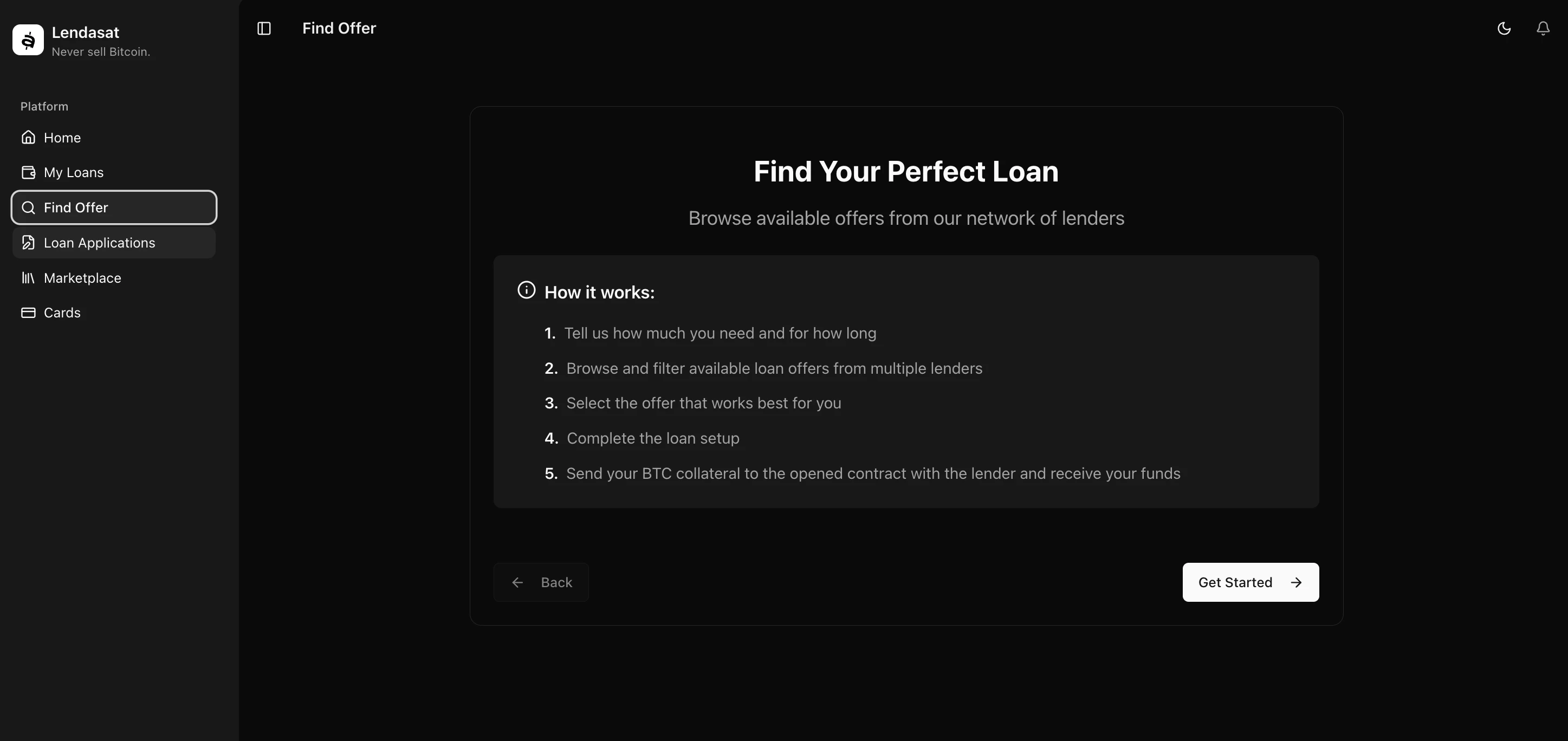

When you take a loan on a non-custodial platform like Lendasat, the process is straightforward:

- You retain ownership: Your Bitcoin is never sold or rehypothecated.

- You lock value: You deposit BTC into a secure, verifiable escrow.

- You receive liquidity: You get stablecoins (or Fiat via partners) to spend immediately.

- You restore access: Once the loan is repaid, your Bitcoin is released back to your wallet.

This strategy solves short-term cash flow problems without interrupting your long-term investment horizon.

Step 1: Define Your Liquidity Needs

Before interacting with the protocol, you need a plan. Borrowing is a financial commitment, and clarity reduces risk. Ask yourself two questions:

- How much do I really need? Only borrow what is necessary to cover your specific expense to minimize collateral lock-up.

- What is my repayment timeline? Do you expect a cash inflow in 3 months? 6 months? Always match your loan duration to your expected income source.

Lock your BTC and borrow cash now

Step 2: Choose Your Route (Take vs. Make)

Lendasat offers two distinct ways to secure a loan, allowing you to prioritize either speed or specific terms.

Option A: Accept an Existing Offer (Instant Liquidity)

If speed is your priority, browse the "Borrow" marketplace. Here, lenders have already posted capital with set parameters (APR, Duration, LTV). If you see an offer that fits your needs, you can accept it and receive funds almost immediately.

Option B: Create a Request (Custom Terms)

If you require specific conditions, such as a specific duration or a lower interest rate, you can create a "loan application". This posts your desired terms to the order book. Lenders can then view your request and choose to fund it. This acts similarly to a "limit order" in trading.

Step 3: Understand Loan-to-Value (The Safety Buffer)

The most critical safety setting in your loan is the Loan-to-Value (LTV) ratio. This determines how much Bitcoin you need to lock up compared to the cash you receive.

- Conservative (50% LTV): You lock double the value of the loan in Bitcoin. This provides a massive safety buffer. The price of Bitcoin would have to crash significantly before your loan is at risk.

- Aggressive (70% LTV): You lock less Bitcoin. While capital efficient, this requires constant monitoring. A sudden market wick could pull you into the liquidation zone.

Recommendation: If your goal is peace of mind, always opt for a lower LTV. It is the cost of sleeping well at night.

Step 4: Verify The Security (Non-Custodial)

In previous cycles, borrowing against crypto often meant sending your coins to a centralized company (CeFi). If those companies went bankrupt, your coins were lost.

Lendasat functions differently by using a 2-of-3 Multisig Escrow:

- Key 1: Held by You (The Borrower).

- Key 2: Held by The Lender.

- Key 3: Held by the Lendasat Oracle (for dispute resolution).

For funds to move, 2 of 3 keys must sign. Lendasat cannot move your funds alone, and the lender cannot steal your funds. Your collateral lives on the Bitcoin blockchain, transparent and verifiable, not in a corporate database.

Step 5: Manage the Loan

Once the loan is active, your primary job is to monitor your LTV. If the price of Bitcoin drops, your LTV rises.

Lendasat provides notification warnings as you approach risk levels. You have two options if the market turns against you:

- Top Up: Add a small amount of Bitcoin to the escrow to lower your LTV.

- Partial Repayment: Pay back a portion of the loan to reduce the debt.

Note: Protocol liquidation only occurs at 90% LTV. This is a generous threshold designed to give borrowers ample time to react to volatility.

Conclusion: A Tool, Not a Trade

Bitcoin-backed loans transform Bitcoin from a passive rock into a productive financial instrument. By borrowing against your assets, you gain the flexibility of cash without the tax consequences or opportunity cost of selling.

Used responsibly, with conservative LTVs and a clear repayment plan, it is one of the most powerful utilities available to a Bitcoiner in 2026.