Lendasat has officially announced a transformative upgrade to its flagship platform, Lendaswap: the integration of full support for Bitcoin on-chain swaps.

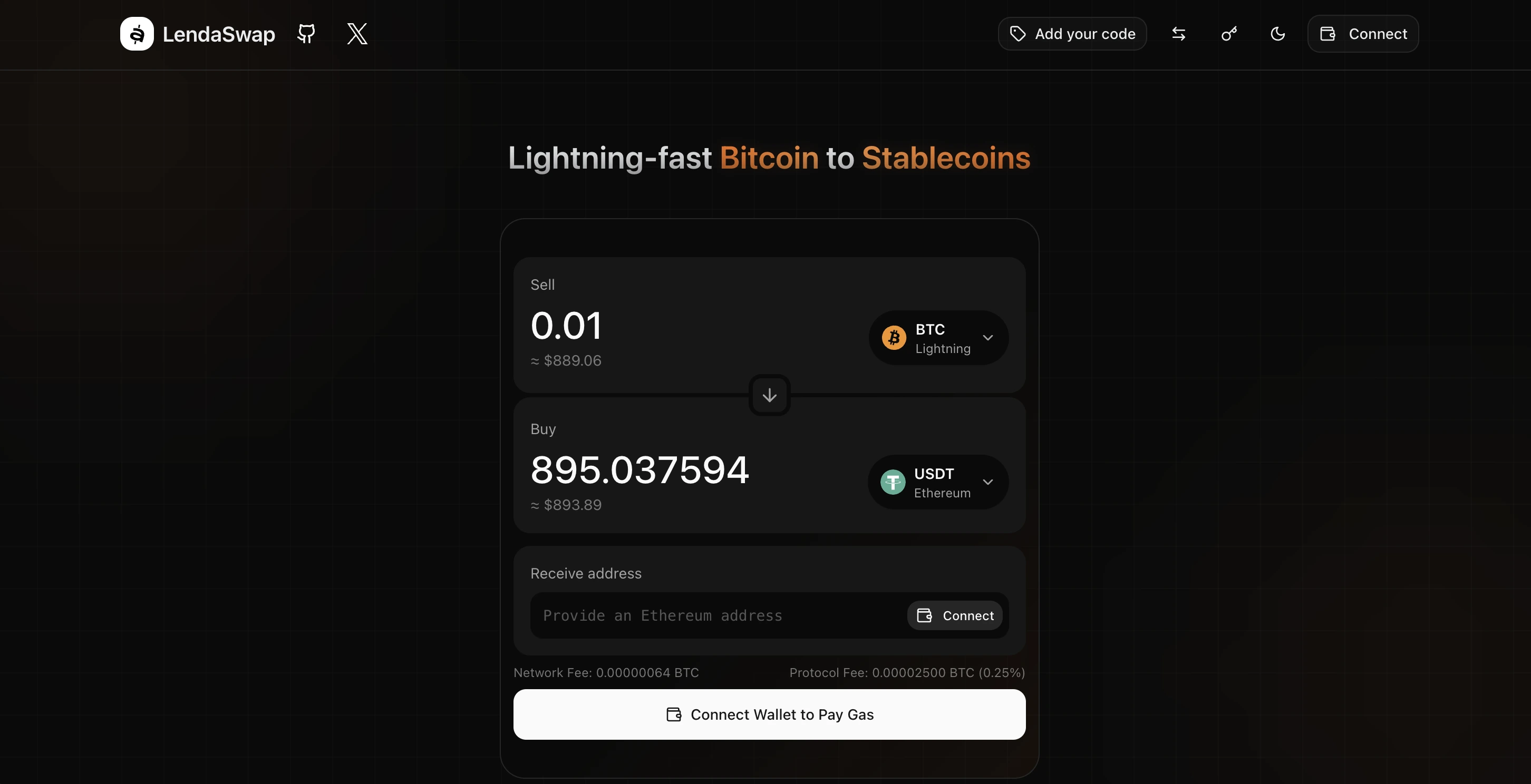

For the first time, users can execute trustless, non-custodial atomic swaps between Bitcoin on-chain, Bitcoin Lightning, and USDC or USDT on Ethereum and Polygon. This update removes the need for accounts, centralized intermediaries, or custodial risks, marking a significant milestone for Bitcoin-native finance.

While Lendaswap previously pioneered atomic swaps on the Lightning Network for instant settlement, the addition of the Bitcoin base layer provides the ultimate settlement security for larger trades. This evolution positions Lendaswap as the premier solution for users seeking true sovereignty over their digital assets.

Mastering Bitcoin On-Chain Atomic Swaps

The core innovation of this update is the ability to swap assets directly between blockchains without a "middleman" holding the funds. Lendaswap now supports direct route for: BTC (On-Chain) ↔ Stablecoins (Ethereum or Polygon)

This is achieved through Atomic Swaps. Unlike traditional exchanges where you deposit funds into a wallet owned by a corporation, an atomic swap is a cryptographic contract. It enforces a strict rule: either both parties receive their funds, or the transaction is canceled and funds are returned.

How the Technology Works

The process uses Hashed TimeLock Contracts (HTLCs) to keep swaps mathematically trustless. When you initiate a swap on Lendaswap:

- Cryptographic Commitment: Both parties lock assets in HTLCs on their respective blockchains using the same hash (H = hash(secret)). Funds stay in the contracts, and no third party ever takes custody.

- Atomic Execution: The swap links both contracts. When one party redeems the first contract, they must reveal the secret on-chain. The counterparty then uses that revealed secret to redeem the second contract.

- Timelock Expiry: If the swap does not complete, each party can reclaim their funds after the timelock expires by broadcasting a refund transaction through the contract’s refund path.

This mechanism ensures that no intermediary can freeze, seize, or re-route your assets. It is a pure atomic exchange enforced by code rather than trust in a company.

👉 Try Your First Trustless Swap on Lendaswap Now

Why Lendaswap Outperforms Bridges

The crypto industry has long been plagued by the risks associated with moving Bitcoin into the DeFi ecosystem. Until now, users wanting to swap BTC for stablecoins generally had to rely on two flawed methods: Centralized Exchanges (CEXs) or Cross-Chain Bridges.

Both methods introduce counterparty risk. History is littered with examples of custodians failing, bridges being exploited, and "wrapped" assets (like WBTC) losing their peg or seeing the custodian seized.

Lendaswap eliminates these trade-offs entirely by offering a No-Wrapping, No-Custody solution.

The Lendaswap Advantage

No Custody: You retain full control of your private keys; Lendaswap never holds funds.

No KYC: Access is permissionless, no accounts or identity verification hurdles.

Sovereignty: Eliminates reliance on third parties, adhering to Bitcoin core principles.

For users who hold BTC for security and long-term storage, this update provides a vital off-ramp and on-ramp that does not compromise the security model of the Bitcoin network.

Conclusion

Lendaswap is closing the gap between Bitcoin’s security and the utility of stablecoins. By removing the chokepoints of centralization, it is building a financial system where Bitcoin is not just held, but actively used.

Experience the future of trustless trading.