Setting the right Annual Percentage Rate (APR) is the single most important decision you make as a lender. It determines not only how much you earn, but whether your capital gets deployed at all.

Set your rate too high, and borrowers will scroll past you to a cheaper competitor. Set it too low, and you leave potential yield on the table.

Because Lendasat is a transparent, peer-to-peer order book—not a black-box liquidity pool—you have the unique ability to price your capital based on real market demand. But APR is just one part of the equation. Smart lenders know how to adjust five specific variables to win borrowers without racing to the bottom on price.

Here is how to analyze the market and choose the perfect APR for your lending strategy.

Understanding APR on Lendasat

On Lendasat, the APR acts as a fixed-income instrument. Unlike DeFi lending protocols (like Aave or Compound) where rates fluctuate block-by-block based on utilization, your Lendasat rate is locked in the moment the loan begins.

This provides certainty:

- Fixed Rate: The borrower pays the exact rate you agreed upon.

- Contractually owed interest: Because we use a "Pay at End" structure, the full interest amount is due even if the borrower repays early.

- Protected Yield: The interest owed is calculated based on the agreed APR, regardless of whether the loan ends via repayment or liquidation.

Create your first lending offer

Step 1: Analyze the Order Book

Before typing a number into the percentage field, you need to know the "market price" for money.

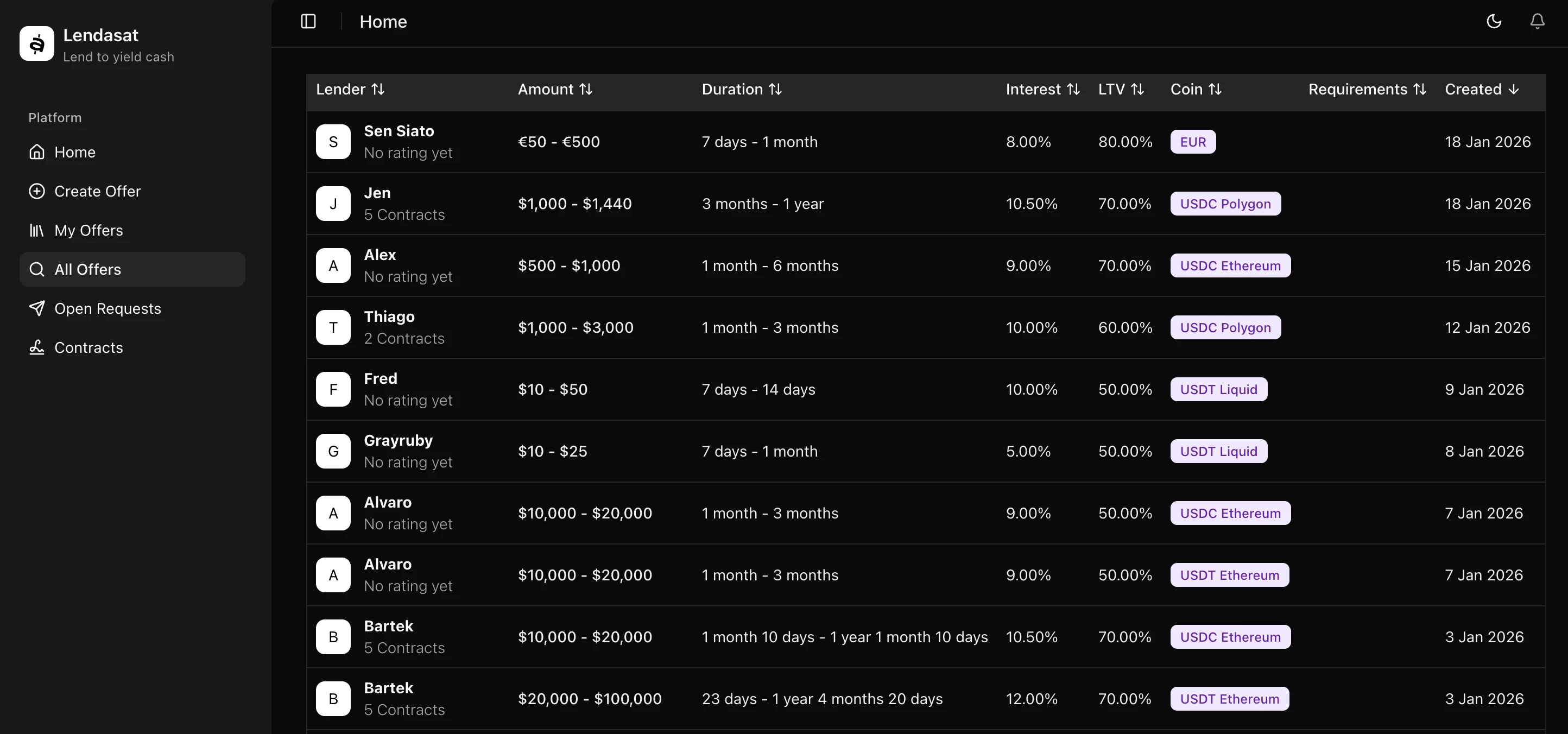

Navigate to the Find Offer section of the dashboard. This is your window into current market sentiment. Filter the available offers by the asset you intend to lend (e.g., USDC) and the network (e.g., Polygon).

Look for patterns:

- What is the average APR for short-term loans vs. long-term loans?

- Are there many unsatisfied offers at a certain price point?

- Which offers are disappearing (getting filled) the fastest?

Think of existing offers as your competition. You need to provide a reason for a borrower to pick you over them.

The 5 Levers of Competitiveness

Many new lenders make the mistake of thinking APR is the only thing that matters. In reality, borrowers are looking for the best overall package.

You can often charge a higher APR if you offer better terms elsewhere. Here are the five levers you can pull to make your offer attractive:

1. The Price Lever (APR)

This is the most obvious tool. If the market average is 9% and you offer 8.5%, you will likely be matched quickly. However, continually undercutting the market isn't always necessary if your other terms are strong.

2. The Duration Lever (Time)

Borrowers crave certainty. Many borrowers, especially those with long-term liquidity needs, prefer longer durations to reduce refinancing risk.

If competitors are offering 9% for 30-day loans, you might successfully offer 9% (or even 9.5%) for a 360-day loan, simply because you are solving a longer-term problem for the borrower.

3. The Efficiency Lever (LTV)

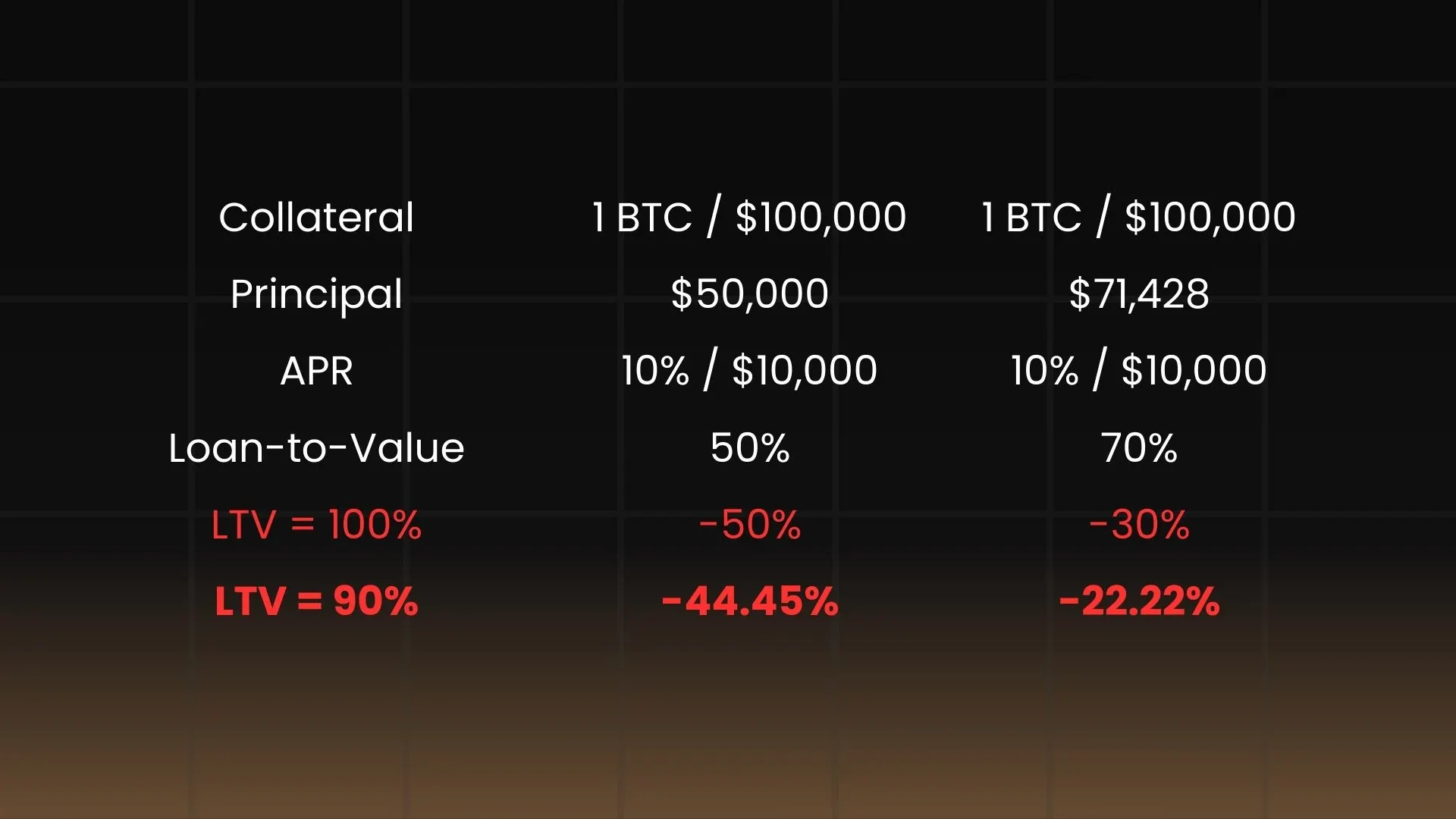

Loan-to-Value (LTV) dictates how much Bitcoin the borrower must lock up.

- 50% LTV → $200 BTC collateral for a $100 loan

- 70% LTV → ~$143 BTC collateral for a $100 loan

A higher LTV is riskier for you (less buffer against volatility), but it is much more capital-efficient for the borrower. Offers with higher LTVs usually command higher demand, often allowing you to maintain a higher APR.

4. The Utility Lever (Asset & Network)

Not all stablecoins are created equal. Borrowers generally prefer USDC on Polygon or Ethereum over options like USDT on Liquid.

Why? Utility. For example, borrowers using the Bringin integration to off-ramp directly to a Euro bank account require USDC on Polygon. If you supply this specific asset, you are providing higher utility, which makes your offer stand out regardless of minor APR differences.

5. The Flexibility Lever (Extensions)

By allowing loan extensions, you give borrowers peace of mind. It signals that if they need more time at the end of the loan, they have the option to ask (which you can still approve or deny). This "optionality premium" is often worth as much to a borrower as a 1-2% difference in APR.

Check current market offers on the dashboard

Choosing Your Strategy

Now that you understand the levers, pick the strategy that fits your goals:

The "Fast Match" Strategy

- Goal: Deploy capital immediately.

- Settings: High LTV (70%), Standard APR, Market-preferred asset (USDC-Polygon).

The "Peace of Mind" Strategy

- Goal: Absolute safety for your principal.

- Settings: Low LTV (50%), strictly conservative.

- Trade-off: You may need to lower your APR slightly below market rate to attract borrowers willing to over-collateralize this heavily.

The "Yield Max" Strategy

- Goal: Highest possible return.

- Settings: Higher APR than market.

- Trade-off: You must offer maximum convenience (Long durations, Extensions enabled, High LTV) to justify the price.

Conclusion

On Lendasat, you aren't just a lender; you are a market maker. Your APR is not a permanent tattoo, it is a price tag you can adjust.

If you create an offer and it hasn't been picked up in 24 hours, don't just wait. Go back to the dashboard, check the competition, and adjust one of your levers. Maybe lower the rate, maybe increase the duration, or maybe switch networks.

Ready to price your first loan?