Applying the Billionaire Playbook to Bitcoin

Wealthy individuals rarely sell their appreciating assets. Instead, they follow a simple yet powerful strategy: Buy, Borrow, Die. 🔑 They buy assets that appreciate over time, borrow against those assets when they need cash, and die without ever selling-passing their wealth to heirs with significant tax advantages.

This strategy allows them to:

Enjoy liquidity without triggering capital gains taxes Maintain ownership of appreciating assets Preserve wealth across generations

What if Bitcoiners could adopt the same wealth-building approach? Over time, many Bitcoin holders have gradually stopped trying to time the market. Instead, they've adopted a simpler, and often more effective, first step: HODLing

🔒But HODLing alone doesn't solve the liquidity problem. After all, who hasn't sold their bitcoin too early, only to watch it skyrocket days or weeks later? 🙃

🔮It's a classic mistake, one that's nearly impossible to avoid unless you have a crystal ball.

Bitcoin has been the best-performing asset of the past decade. So why even think about selling it? Doing so comes with significant risk.

That's exactly why Lendasat is building the most secure and user-friendly peer-to-peer lending platform for Bitcoin - so you can unlock the value of your BTC without ever needing to sell, completing the full "Buy, Borrow, Die" strategy for Bitcoin holders.

Don’t sell, borrow against your ₿itcoin

Selling your Bitcoin can be a costly mistake, not just from an investment perspective, but also in terms of taxation and privacy. 🕵️

Realizing capital gains typically means paying taxes, and selling through a centralized exchange often requires revealing the origin of your funds on-chain, compromising your financial privacy.

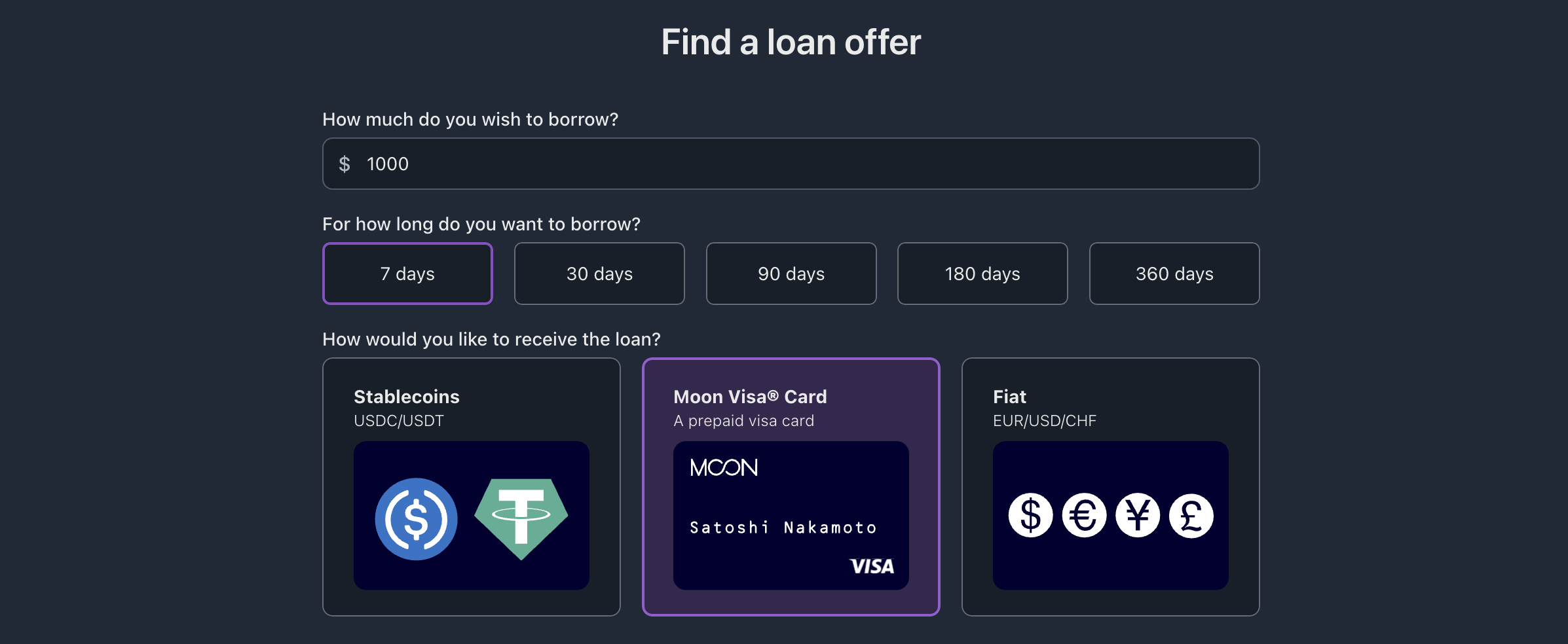

Instead, Lendasat allows you to deposit your BTC as collateral and receive stablecoins 🪙, fiat currency 💵, or even a virtual credit card 💳 in return.

What difference does it make❓

You don’t sell your Bitcoin, so you remain fully exposed to its future price appreciation. You get access to cash when you need it most, and you can repay later. 💆

Even better, this action is not taxable, since you're not realizing a gain. In other words, you can live off your Bitcoin while spending fiat, a currency that loses value every year.

Here is a practical example

Imagine you own 1 BTC, and today, Bitcoin is trading at $100,000. You need short-term liquidity, let’s say $50,000, to fund a project, cover some expenses, or seize a business opportunity.

You have 2️⃣ choices: Sell your Bitcoin, or use it as collateral to borrow.

👉 In the 1st case, you sell half your BTC to receive $50,000. But that means you’ve exited your position. If Bitcoin’s price rises afterward, you’ll no longer benefit from the upside. You may also be subject to capital gains tax, depending on your country’s regulations.

And more importantly, you’ve given up part of a scarce asset, one with massive long-term potential, just to meet a short-term need.

👉 In the 2nd case, you choose not to sell. You deposit your 1 BTC as collateral on Lendasat and borrow $50,000 (50% of its value). The BTC remains yours, securely locked in a non-custodial multisig vault.

📈 Now imagine Bitcoin rises to $200,000. You could simply repay the $50,000 loan plus interest, and reclaim your BTC - now worth $200,000.

You accessed liquidity when you needed it, without selling, and fully benefited from the price appreciation.

Alternatively, you could use the increased value of your BTC to borrow again, covering future expenses without ever selling a single satoshi.

Had you sold half your BTC at the beginning, you would have missed out on a 100% price gain on that portion, and to access another $50,000 you’d have to sell the rest. But by using your BTC as collateral, you’d now have an asset worth $200,000 and a debt of only $50,000 - or perhaps $100,000 if you’ve borrowed again. You remain long BTC, while gaining access to fiat.

😑 If Bitcoin stays at $100,000, the outcome is still favorable. You repay the loan, recover your collateral, and meet your cash needs without ever exiting your position or triggering a taxable event. Your long-term exposure is fully preserved.

📉 If Bitcoin drops to $60,000, the situation becomes tighter. Your collateral value decreases, and your loan-to-value (LTV) ratio rises to 83%. Once you hit the 90% threshold, liquidation becomes possible—but you're not locked in. Simply add more Bitcoin to your collateral position whenever needed to keep your loan safe.

If liquidation happens, the lender will sell part or all of your BTC to cover the loan. You lose the collateral, but you don't owe anything beyond that - the debt is settled.

Even then, you had quick access to $50,000 exactly when you needed it and you did it without selling or relying on a bank.

This is precisely how wealthy individuals operate: they don’t spend their assets, they put them to work as collateral.

Selling an asset like Bitcoin is even riskier, because you’re giving up not just something valuable, but something with enormous potential. 💎